Harwood company uses a job order costing system – Harwood Company’s implementation of a job order costing system is a strategic move that underscores its commitment to efficient cost management and profitability. This system plays a pivotal role in capturing, accumulating, and assigning costs to specific jobs, providing invaluable insights for informed decision-making and operational excellence.

Job order costing, as employed by Harwood Company, is a cost accounting method tailored to organizations that produce unique products or services on a per-order basis. It enables precise tracking of costs associated with each job, ensuring accurate costing and profitability analysis.

Job Order Costing System Overview

Job order costing is a cost accounting system used by companies that manufacture products or provide services on a custom basis. In this system, costs are accumulated for each individual job or order. Harwood Company, a manufacturer of custom furniture, uses a job order costing system to track the costs associated with each piece of furniture it produces.

The key elements of a job order costing system include job orders, cost sheets, and overhead allocation. Job orders are documents that authorize the production of a specific job. Cost sheets are used to accumulate the costs associated with each job.

Overhead allocation is the process of assigning indirect costs, such as factory rent and utilities, to each job.

Job Costing Process

The job costing process at Harwood Company involves the following steps:

- When a customer places an order for a piece of furniture, a job order is created.

- The job order is used to track the costs associated with the job, including direct materials, direct labor, and manufacturing overhead.

- Direct materials are the materials that are used directly in the production of the furniture.

- Direct labor is the labor that is used directly in the production of the furniture.

- Manufacturing overhead is the indirect costs that are incurred in the production of the furniture, such as factory rent and utilities.

- The costs are accumulated on the job cost sheet.

- Once the job is completed, the job cost sheet is used to calculate the total cost of the job.

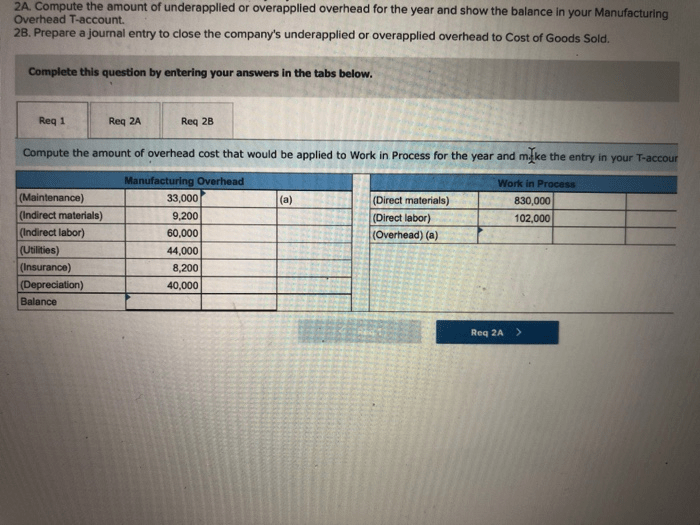

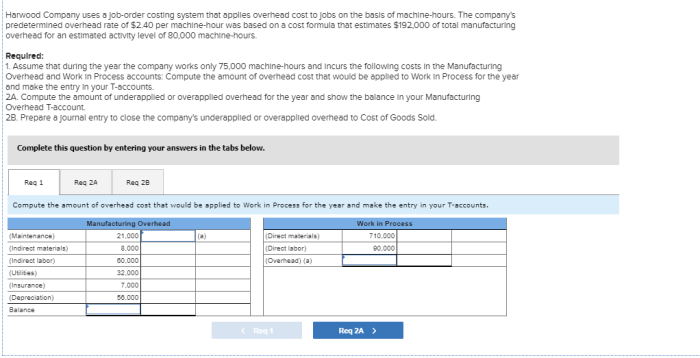

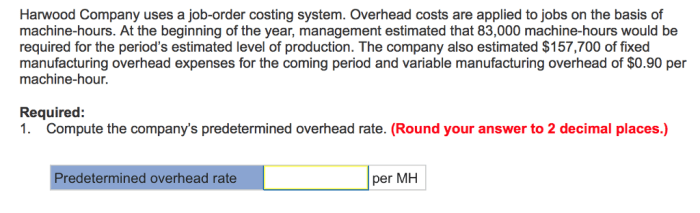

Overhead Allocation Methods: Harwood Company Uses A Job Order Costing System

Harwood Company uses two overhead allocation methods: the actual overhead rate method and the predetermined overhead rate method.

- The actual overhead rate method allocates overhead costs to jobs based on the actual overhead costs incurred during the period.

- The predetermined overhead rate method allocates overhead costs to jobs based on an estimate of the overhead costs that will be incurred during the period.

The actual overhead rate method is more accurate than the predetermined overhead rate method, but it is also more time-consuming. The predetermined overhead rate method is less accurate than the actual overhead rate method, but it is also less time-consuming.

Cost Accumulation and Reporting

Harwood Company accumulates job costs on job cost sheets. The job cost sheets include the following information:

- Job order number

- Customer name

- Product description

- Direct materials

- Direct labor

- Manufacturing overhead

- Total cost

Harwood Company uses the job cost sheets to generate a variety of reports, including:

- Job cost reports

- Cost of goods manufactured reports

- Income statements

Cost Analysis and Control

Harwood Company uses job costing information for cost analysis and control purposes. The company uses the job cost information to:

- Identify inefficiencies in the production process

- Improve profitability

- Make informed decisions about pricing

By understanding the costs associated with each job, Harwood Company can identify areas where it can improve efficiency and reduce costs.

System Design Considerations

When designing a job order costing system, there are a number of factors to consider, including:

- The nature of the business

- The volume of production

- The complexity of the products

- The availability of resources

The nature of the business will determine the type of job order costing system that is most appropriate. For example, a company that manufactures a wide variety of products will need a more complex job order costing system than a company that manufactures a single product.

System Implementation and Maintenance

Implementing and maintaining a job order costing system can be a challenge. The following are some of the challenges that Harwood Company faced when implementing its job order costing system:

- Collecting accurate data

- Training employees on the new system

- Integrating the system with other accounting systems

Harwood Company overcame these challenges by:

- Developing a comprehensive data collection plan

- Providing extensive training to employees

- Working closely with the IT department to integrate the system with other accounting systems

Expert Answers

What are the key benefits of Harwood Company’s job order costing system?

Harwood Company’s job order costing system provides several key benefits, including accurate job costing, improved cost control, enhanced profitability analysis, and informed decision-making.

How does Harwood Company accumulate costs for each job?

Harwood Company accumulates costs for each job by capturing direct materials, direct labor, and manufacturing overhead costs incurred during the production process. These costs are then assigned to specific jobs based on predetermined allocation methods.

What are the different overhead allocation methods used by Harwood Company?

Harwood Company utilizes various overhead allocation methods, including the direct labor hour method, the activity-based costing method, and the plant-wide overhead rate method. The selection of an appropriate method depends on the nature of the business and the production process.